Across the nation, symptoms of the recent red-hot real estate market appear to be cooling. Demand is slowly waning, prices are beginning to plateau and homes are remaining on the market longer. All of these changes have raised concerns around the future of mortgage and real estate.

Simply put, there’s fear that this real estate cooldown could be a symptom/result of an impending economic recession.

The reality is, though, that these factors are not necessarily cause for concern. It could actually be a good time to be in the housing industry – and mortgage specifically.

Before we dive into the nitty-gritty, let’s take a quick look at why we’re still bullish on home loans:

Mortgage loan volume tends to balance against home purchase volume making it the ideal option for diversifying your revenue streams.

Slowing demand and plateauing home prices may actually be good for the overall housing market.

Rising interest rates seem to be supporting this shift in the housing market – from wildly skewed toward seller advantage to somewhere closer to the norm.

Not quite convinced? Let’s cover all the details:

Mortgage professionals have the opportunity to capitalize on nearly any housing market conditions

While 2020 saw record-high refinance requests, those requests are ticking down as fewer and fewer homeowners seek rate adjustments to their mortgages. While this fact may seem concerning at first, it’s a natural and predictable part of the industry’s life cycle.

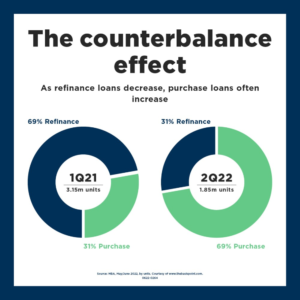

Data overwhelmingly supports the idea that refinance numbers and home purchases often have an inverse relationship. This means that when refinances are high (which typically occurs during times of declining interest rates) traditional real estate transactions tend to fall. It also means that the inverse is true: fewer refinances typically correlate with more home purchases.